new capital gains tax plan

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. The capital gains tax has long been part of the political tug-of-war and with the release of President Bidens FY2022 budget proposal the change to the capital gains tax regime looks to be one of the more interesting proposals.

Long Term Short Term Capital Gains Tax Rate For 2013 2016 Http Capitalgainstaxrate2013 Tumblr Com Post 719 Capital Gains Tax Wealth Planning Capital Gain

The proposal would set the capital gains tax rate for individuals earning over 1 million at 396 percent two people familiar with the plan told Bloomberg.

. Under President Bidens tax plan 13 states and DC. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains. The people impacted by the tax would be able to.

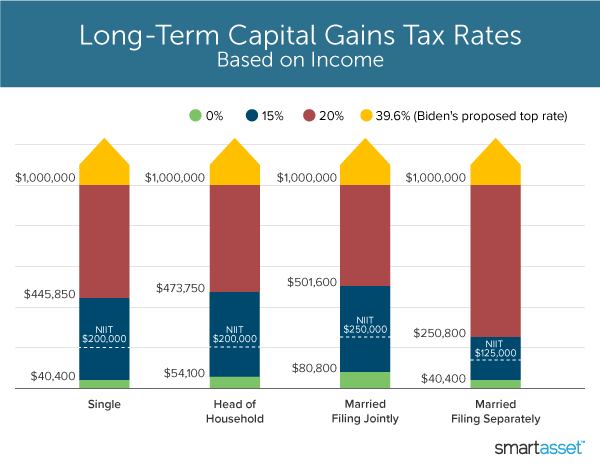

Would have a top combined capital gains tax rate at or above 50. Short-term capital gains are taxed at the same rate as federal income taxes which can be up to 37 while the highest long-term capital gains. President Joe Bidens 2022 budget proposal will raise the top income tax rate up to 396 and double capital gains taxes for investors making over 1 million.

When combined with an. However there is good news for many homeowners. The capital gains tax applies to money earned from investments and it is generally much less than the taxes on money earned as income or wages.

Bidens plan called for a 396 rate on the top 03 of households. If you sold your house in 2021. President Biden on Monday unveiled a new minimum tax targeting billionaires as part of his 2023 budget request proposing a 20 rate that would hit both the income and unrealized capital gains of.

4 rows The capital gains tax on most net gains is no more than 15 for most people. You can exclude up to 250000 of capital gains if you are single. Dont Forget The Net Investment Income Tax The 396 rate would be in addition to the current 38 net investment income tax NIIT for a combined total of 434.

That increase which would include federal state and local taxes on financial gains from the sale of assets in New Hampshire. Capital Gains Tax Rate Set at 25 in House Democrats Plan. If your taxable.

The impacted assets include stocks bonds real estate and art. Bidens 58 trillion budget proposal includes a tax on unrealized gains meaning some Americans would have to pay for the appreciation of assets like stocks even before they sell those assets. The current rates are 0 15 or 20 depending on income.

The tax would apply to people who make more than US 100 million a year for three years in a row or if one makes US 1 billion in annual income. President Biden is expected to announce a proposal to nearly double the capital gains tax rate in order to help fund a forthcoming spending package according to multiple reports. Currently all long-term capital gains are taxed at 20.

The combined state and federal capital gains tax rate in New Hampshire would rise from the current 288 percent to 484 percent under President Bidens American Families Plan according to a new study from the Tax Foundation. The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. House Democrats are calling for a 25 top federal tax rate on capital gains.

The new capital gains tax rate varies based on your income level property type and filing status. Biden had wanted to boost rate to 396 for highest earners. A quick refresher on our current capital gains tax system.

That plan endorsed by 6 Democrats and all 13 Republicans on the Ways and Means Committee would reduce the tax rate on capital gains to about 20 percent for two years and then return it to the. When you include the 38 net investment income tax NIIT that rate jumps to. Corporate Taxes Right now the.

The planwhich would apply only to households with a net worth of 100 million or morewould levy a minimum tax of 20 on all income plus unrealized capital gains. However the state does allow taxpayers with income from capital gains to claim a special tax deduction that is equal to up to 40 of the total income from net capital gains or 1000 of the net capital gains reported whichever is larger. Rate would rise from 20 under House panels proposal.

There are exclusions on the capital gains tax for people who sold their homes in the past year. The Center Square President Joe Bidens newly released 2023 budget included a tax provision that has come under extra scrutiny. New Mexico Capital Gains Tax In New Mexico capital gains are taxable as personal income.

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Payroll Taxes

Capital Gains Tax Capital Gain Integrity

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

Capital Gains Definition 2021 Tax Rates And Examples

What S In Biden S Capital Gains Tax Plan Smartasset

South Korean Lawmakers Introduce Bill To Legalize New Icos Capital Gains Tax Capital Gain South Korea

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investing

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Capital Gains Tax Brackets For Home Sellers What S Your Rate Capital Gains Tax Capital Gain Tax Brackets

What You Need To Know About Capital Gains Taxes Now Forbes Capital Gains Tax Capital Gain Income Tax Brackets

Pin By Jackie Kittle On Financials Tax Brackets Capital Gains Tax Capital Gain

The Tax Impact Of The Long Term Capital Gains Bump Zone Capital Gain Capital Gains Tax Tax

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Investing Capital Gain

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis 042621 Raising Capital Capital Gain How To Plan

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube Family Finance Capital Gains Tax Capital Gain

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)